24 Jul Will GST affect your Wedding Preparations? Know it All

Will GST affect your Wedding Preparations? Know it All !

In 2016, demonetization came to us like a shock, GST is another one for 2017. While demonization was a little clearer, GST is a bit confusing for everyone, and for everyone out there who is going to tie a knot in the next few months.

So this is how GST will affect your wedding and how you can work about it.

1)WEDDING SHOPPING

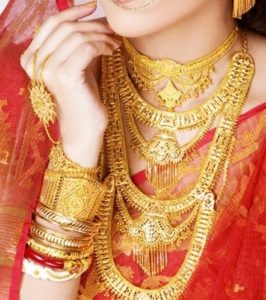

- GOLD-

The most important element of the “Shaadi” season. A marriage without GOLD is not possible. Which has not become a little more expensive compared to the earlier. Frome 1.8% to 3% = NooooL

- COSTUME JEWELER –

Who doesn’t love faux kundan? Good news guys, it’s going to get cheaper! The tax for this has reduced to 12%.

- CLOTHING+APPARELS-

The only good thing about GST is “More Shopping”. Footwear and clothing will get cheaper under GST, up to Rs 1000 is reduced to 5% and above 1000 it is 12% = YayyieeJ

- MAKE-UP & PERFUMES –

This is sad for all the brides since, beauty centres and all the make-up product rates are going to get high because of GST. The tax charged on these products is going to be 28%. So the dreamy Channel and Sephora make-up you dreamt off owing just got even more pricier. Which is why your make-up artist will also hike up her prices. So be prepared guys!

2) WEDDING SERVICES-

PHOTOGRAPHY SERVICES-

The most Important part of your Wedding – Your Wedding Photographer ! Photography falls under the 28% for Wedding Services, in some cases under the 18% Bracket like Karizma Albums and Printing Services. You need to choose your Photographer very wisely, either you pay the premium or sort it in cash if your getting an advantage. Consider choosing BX Studio in both cases 😉

CATERING SERVICES-

Considering the prices of the food products to get tax less (i.e milk, rice, wheat, grains, paneer, vegetables etc.) you can consider negotiating with your caterer and ask him to pass on the discount to you too. So your cost factor will also reduce.

- VENUE-

GST is going to make all the 5 star hotels a bit more expensive because of the 28% GST Tax implementation on luxury items. Which leads to more budget allocation for stay and venue!

For budgeted hotels it may however be cheaper.

3)MISCELLANEOUS WEDDING EXPENSES-

- HONEYMOON-

The dream travel just got more expensive because of GST. The business class ticket is going to be expensive because of the 28% tax implementation, so the dream honeymoon ticket is going to be super expensive. But don’t be upset, the economy travel and the AC trains are now going to get much cheaper, if you travel in it.

See more of Honeymoon ideas in our other Blogs !

- INVITATION CARDS & COURIER SERVICES-

The courier services are considerably going to be more expensive since the tax rates are gone up to 18% from 15%. So you can use opt for alternative options like sending your cards through IPS or couriering lighter weight wedding cards (not very big packages).

Hope this blog contained all the information you really needed to plan your wedding. For much such blogs, Stay tune on- http://bxstudio.in/weddings-and-more/

For all you beautiful brides <3!

Blog Author – Sakina Jaliwala

Stay Updated with us for more such Blogs only at : http://bxstudio.in/blog/

You can also SUSCRIBE to our Youtube Channel for Awesome Video Content : https://www.youtube.com/c/AbdealiRoshanBunnyXpressions

See our Facebook Page for regular updates : https://www.facebook.com/bxstudio1

Instagram : https://www.instagram.com/bx.studio

YourFriendPablo

Posted at 10:55h, 31 JanuaryGreat, I really like it! Youre awesome